Regulations for conventional government-backed loans have loosened slightly over the past few years, but for those who are self-employed or still find themselves limited by a recession-induced blemish, a portfolio loan might be the quicker route to approval.

Unlike a typical mortgage that is sold after closing, portfolio loans are funded by your lender and (typically) stay in-house for the duration of the mortgage. Instead of conforming to the standard criteria, the lender has an internal process that can work around issues which might otherwise prevent a loan from getting approved.

Traditionally, portfolio loans were difficult to come by and made up a small percentage of banks total loans, but we recently met with a manager at Talmer Bank and it turns out over 30% of their loans are portfolio; for Chemical Bank, who Talmer is about to merge with, it’s over 60%.

Interested? Connect with us to learn more and we’ll put you in touch with a lender who can make sense of everything you just read.

Lou Bitove & Jeff Bortnick, owners of The New Home Experts®, have more than 30 years combined experience in real estate, much of that with builders like Pulte & Toll Brothers. They also provide market research for area builders, developers and national firms. If you’re considering a new home, remember: the builders rep represents the builder, not you. Work with the only local agents in Metro Detroit to specialize in new homes, and save money in the process – ask us how!

More Articles

Metro Detroit

NEWSLETTER: MAY 2025

AT ANY RATE BECAUSE YOU NEED A PLACE TO LIVE As we roll through 2025, mortgage rates seem to have...

May 16, 2025

Read MoreMetro Detroit

NEWSLETTER: APRIL 2025

WEBSITE INSIGHTS NAVIGATING REAL ESTATE PORTALS & RELATED MISERY Here’s a fun fact - all the listings on those real...

April 19, 2025

Read MoreMetro Detroit

NEWSLETTER: MARCH 2025

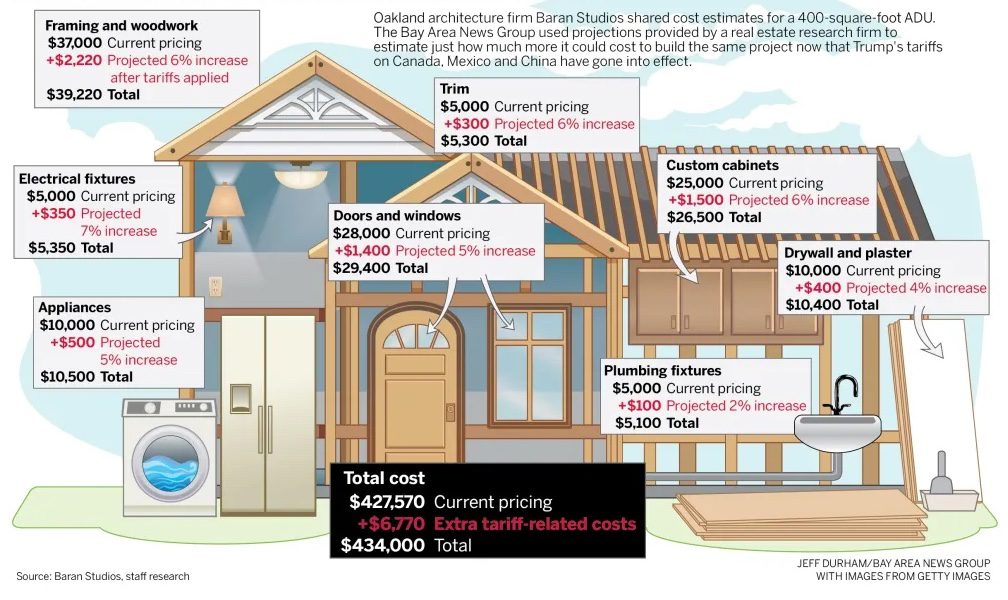

MARCH MADNESS TOURNAMENTS, TIME CHANGES, AND TARIFFS... Meh, March. It starts with ESPN's annual wall-to-wall coverage of college basketball and absolutely...